south dakota sales tax rate on vehicles

In the state of South Dakota sales tax is legally required to be collected from all tangible physical products being sold to a consumer. Enter zip code of the sale location or the sales tax rate in percent Sales Tax.

How Is Tax Liability Calculated Common Tax Questions Answered

Most cities and towns in south dakota have a local sales tax in addition to the state tax.

. Report the sale of a vehicle. Searching for a sales tax rates based on zip codes alone will not work. If a state with no tax or a lower tax rate than South Dakotas 4 then you will need to pay the additional tax rate to match the 4.

Several examples of of items that exempt from South Dakota sales tax are prescription medications farm machinery advertising services replacement parts and livestock. A tool to look up state and municipal sales or. South Dakota Taxes and Rates State Sales Tax and Use Tax Applies to all sales or purchases of taxable products and services.

South dakota sales tax rate on vehicles Friday March 18 2022 The process of tracking individual state sales taxes that enforce economic nexus can be daunting time-consuming and expensive. For cities that have multiple zip codes you must enter or select the correct zip code for the address you are supplying. 4 State Sales Tax and Use Tax Applies to all.

The South Dakota state sales tax rate is 4 and the average SD sales tax after local surtaxes is 583. With local taxes the total sales tax rate is between 4500 and 7500. While south dakotas sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes.

Sales Tax Rates by Address. Just enter the five-digit zip code of the location in. Average Sales Tax With Local.

State sales tax and any local taxes that may apply. In South Dakota certain items may be exempt from the sales tax to all consumers not just tax-exempt purchasers. States with no tax map Florida Texas 7 other from wwwbusinessinsiderde.

Depending on local municipalities the total tax rate can be as high as 65. You have 90 days from your date of arrival to title and license your vehicle in South Dakota. The amount of the.

This means that an individual in the. The cost of a vehicle inspectionemissions test. While the South Dakota sales tax of 45 applies to most transactions there are certain items that may be exempt from taxation.

The South Dakota Department of Revenue administers these taxes. Additionally if you want to avoid surprise maintenance costs after buying a used car you should think about ordering a vehicle. South Dakota has a statewide sales tax rate of 45 which has been in place since 1933.

21500 for a 20000 purchase Roslyn SD 75 sales tax in Day County 20900 for a 20000 purchase Pine Ridge SD 45 sales tax in Shannon County You can use our South Dakota sales tax calculator to determine the applicable sales tax for any location in South Dakota by entering the zip code in which the purchase takes place. 45 The following tax may apply in addition to the state sales tax. Motor Vehicle Gross Receipts Tax Applies to the rental of motorcycles cars trucks and vans for less than.

Municipal governments in South Dakota are also allowed to collect a local-option sales tax that ranges from 0 to 65 across the state with an average local tax of 1814 for a total of 6314 when combined. There are a total of 289 local tax jurisdictions across the state collecting an average local tax of 1814. For additional information on sales tax please refer to our Sales Tax Guide PDF.

South Dakota has a higher state sales tax. Get all the information you will need to title or renew your vehicle registration and license plates for your government vehicles. The South Dakota DMV registration fees youll owe.

The cost of your car insurance policy. 31 rows The state sales tax rate in South Dakota is 4500. This page will be updated monthly as.

Printable PDF South Dakota Sales Tax Datasheet. This table lists each changed tax jurisdiction the amount of the change and the towns and cities in which the modified tax rates apply. Sales Tax Exemptions in South Dakota.

The South Dakota sales tax and use tax rates are 45. Click Search for Tax Rate Note. 4 State Sales Tax or Use Tax Applies to all sales or purchases of taxable products and services.

Tax Rate State sales tax 45 2115 Rapid City sales tax 2 940 Tourism Tax 15 705 Motor Vehicle Gross 45 2115. The South Dakota SD state sales tax rate is currently 45. See Sales Tax Guide.

Other local-level tax rates in the state of South Dakota are quite complex compared against local-level tax rates in other states. Print a sellers permit. What Rates may Municipalities Impose.

Municipal Sales Tax or Use Tax. Find out the estimated renewal cost of your vehicles. Over the past year there have been ten local sales tax rate changes in South Dakota.

South Dakota has recent rate changes Thu Jul 01 2021. This page discusses various sales tax exemptions in South Dakota. Are Dental Implants Tax Deductible In Ireland.

Important South Dakota County Commissioners information including land assessment. Lowest sales tax 45 Highest sales tax 75 South Dakota Sales Tax. South Dakota has 142 special sales tax jurisdictions with local sales taxes in addition to the state sales tax.

The sales tax applies to the gross receipts of all retail sales including the sale lease or rental of tangible personal property or any product transferred electronically and the sale of services. Sales Tax Rate Lookup. Any titling transfer fees.

This is the case even when the buyers out-of-pocket cost for the purchase is 10800. The state sales and use tax rate is 45. With local taxes the total sales tax rate is between 4500 and 7500.

South Dakota has state sales tax of 45 and allows local governments to collect a local option sales tax of up to 6. Select the South Dakota city from the. All brand-new vehicles are charged a 4 excise tax in the state of South.

South Dakota Taxes and Rates Motor Vehicle Excise Tax Applies to the purchase of most motor vehicles. South Dakota municipalities may impose a municipal sales tax use tax and gross receipts tax. South Dakota Taxes and Rates Motor Vehicle Excise Tax Applies to the purchase of most motor vehicles.

Average DMV fees in Kentucky on a new-car purchase add up to 21 1 which includes the title registration and plate fees shown above. Counties and cities can charge an additional local sales tax of up to 2 for a maximum possible combined sales tax of 6. However the buyer will have to pay taxes on the car as if its total cost is 12000.

Municipalities may impose a general municipal sales tax rate of up to 2.

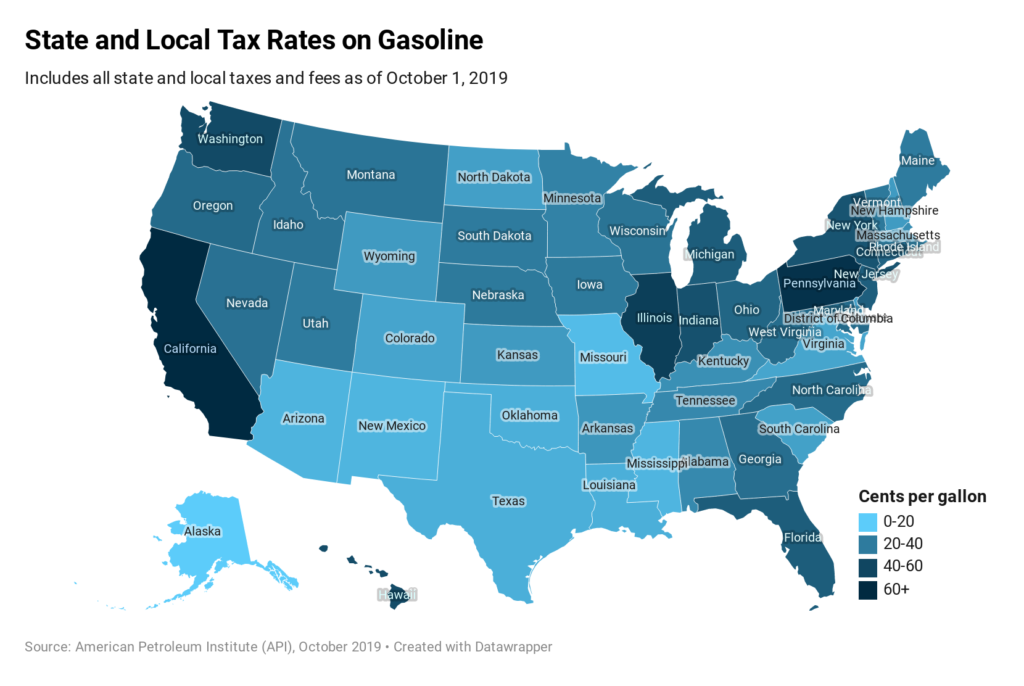

What Is The Gas Tax Rate Per Gallon In Your State Itep

Pin On Form Sd Vehicle Title Transfer

Saab 95 Factory Roof Rack With Thule Wind Visor Roof Rack Saab Sports Car

Car Tax By State Usa Manual Car Sales Tax Calculator

Vehicle Buying Do You Pay Sales Tax For The State You Buy From Or Live In

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

A Complete Guide On Car Sales Tax By State Shift

Sales Taxes In The United States Wikiwand

What S The Car Sales Tax In Each State Find The Best Car Price

Car Tax By State Usa Manual Car Sales Tax Calculator

South Dakota Sales Tax Small Business Guide Truic

Nj Car Sales Tax Everything You Need To Know

Sales Taxes In The United States Wikiwand

Car Tax By State Usa Manual Car Sales Tax Calculator

What S The Car Sales Tax In Each State Find The Best Car Price

Oklahoma Vehicle Sales Tax Fees Calculator Find The Best Car Price

What S The Car Sales Tax In Each State Find The Best Car Price

What Is The Tax Percentage Paid By Businesses In Different Countries Answers Map World Map Showing Countries Slavery

Caddyshack Golf Carts Mini Mustangs Cobras Raptors Golf Carts Golf Car Golf